From the office of Representative John Carter, Texas Thirty One:

From the office of Representative John Carter, Texas Thirty One:

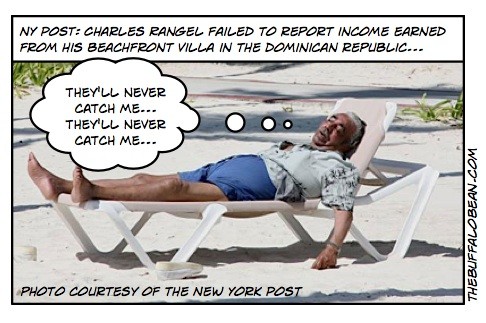

All U.S. taxpayers would enjoy the same immunity from IRS penalties and interest as House Ways and Means Chairman Charles Rangel (D-NY) and Obama Administration Treasury Secretary Timothy Geithner, if a bill introduced today by Congressman John Carter (R-TX) becomes law.

Texas judge, today introduced the Rangel Rule Act of 2009, HR 735, which would prohibit the Internal Revenue Service from charging penalties and interest on back taxes against U.S. citizens. Under the proposed law, any taxpayer who wrote “Rangel Rule” on their return when paying back taxes would be immune from penalties and interest

Hat tip: Ramesh Ponnuru, National Review.

My reading of the Fourteenth Amendment is not so much as it enshrines a specific set of rights, but rather that it prohibits classes of citizenship. That is the state can not have one rule for citizen who not congresscritters and another rule for those who are congresscritters. Or to coin a phrase, what good for the goose is good for the gander.

Tags: carter texas, chairman charles, charles rangel, citizens, congressman john, hat tip, immunity, internal revenue service, irs penalties and interest, john carter, Obama, paying back taxes, representative john, taxpayers, texas judge, timothy geithner, treasury secretary, ways and means